Bear Markets & CARES Act

Could the worst be over? Some market strategists are calling the end of the bear market already … do you think they’re right? (Keep reading to see what could be behind the surge, as well as a breakdown of how the $2 trillion CARES Act affects your wallet.) With markets whipping between rallies and retreats, […]

What Is Medigap Insurance and How Does it Work?

For those who are 65 and older or living with certain disabilities, Medicare is a federal health insurance program designed to cover certain expenses such as hospital stays, doctor’s appointments and prescriptions.1 What each individual or couple has coverage for depends on the different Medicare parts and options – such as Part A, Part B, and […]

The Most Common Mistakes Pre-Retirees Make

When nearing retirement your thoughts start to drift farther and farther away from the job at hand and closer to what you’ll be able to do in all that free time – catch up on some reading, enjoy an afternoon on the back nine or travel the world with your husband or wife. But as […]

Will I Qualify For Public Service Loan Forgiveness (PSLF)?

Public Service Loan Forgiveness is one of the best ways to get rid of those pesky student loans but beware, there are 3 essential requirements you must meet to qualify for PSLF. You must make 120 on-time payments on the right type of loan You must be enrolled in the right type of repayment plan […]

6 Estate Planning Tips For Your Business

As a business owner, you’ve invested time, money and your heart into building this income-producing enterprise. Estate planning is a legal method of protecting the business in case of unfortunate events. It’s a tailored business tool to control and manage the wealth you’ve built by preventing taxation seizures and safeguarding the intended transfer of ownership […]

The Emotional Effects of Debt

If you’ve been fighting debt, you’re not alone. As it stands, the average American has $15,950 in credit card debt, and 39% of Americans carry a balance from month to month.1 Those figures aren’t counting people with mortgages, student loans, car notes, personal loans, and medical bills. There are a number of underlying issues that contribute […]

What is the Difference Between Modern Portfolio Theory and Behavioral Finance?

There are two different belief systems that serve as the basis for investment decisions: the modern portfolio theory (MPT) and behavioral finance (BF). A basic summary of the two schools of thought: the MPT focuses on the optimal state of the market, while BF is more focused on the actual state of the market. With […]

Smart Money Habits For Recent College Grads

If you recently graduated from college, congratulations are certainly in order! In addition to being a major life milestone, college graduation marks an important transition into adulthood. As such, it may also be the beginning of a new phase of personal finance management. The financial decisions you make during this phase in life have a lasting effect […]

What’s The Difference Between A Financial Advisor, Financial Planner, Wealth Advisor & Investment Advisor?

Once you’ve decided it’s time to get some professional financial help, you may be asking yourself: “Which type of financial professional is best for me?” From a financial advisor or financial planner to an investment advisor or a wealth advisor, it’s helpful to know the differences between each category of financial experts before committing to […]

Which Medicare Plan Should I Choose?

Which Medicare Plan Is Right For You? Whether you’re looking into Medicare for the first time or taking advantage of open enrollment to update your strategy, this article is for you. Choosing the wrong plan can cost you big-time! Not only is healthcare likely to be the largest expense in your retirement (potentially $285,000 or […]

What Should I Do With My Old 401(k) or Employer Plan?

What should you do with your old 401(k), 403(b), 457 or other Employer Plan? You’ve been a diligent saver and set aside money into your employer’s sponsored retirement plan each pay. Now, as you leave that employer for another or maybe to fully retire, you’re wondering what you should do with the money you’ve set […]

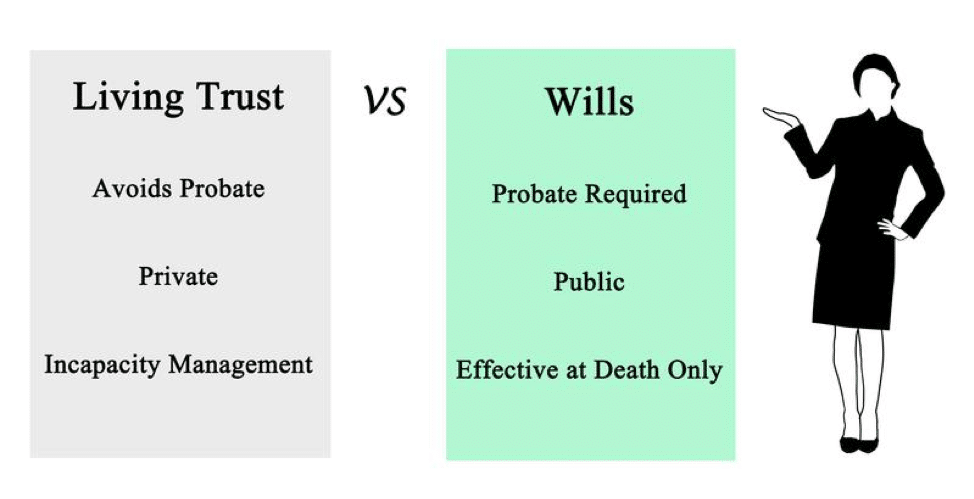

How Do I Know if I Need a Living Trust?

There are many reasons why you may want to have a living trust. In fact, a trust may be worth having even if you don’t think that you have a lot of money. This is because they can ensure that your wishes are met if you aren’t of sound mind to make decisions for yourself. […]

What’s the Difference Between a HELOC and a Home Equity Loan?

Your home can provide you with a convenient and affordable way to consolidate debt or to pay for your child’s college education. Assuming that you have sufficient equity in your home, it may be possible to get either a HELOC or a home equity loan. Let’s look at the differences between the two and how […]

4 Surprising Strategies for Saving on Your Monthly Expenses

Regardless if you are looking to pay off debt, increase your savings, or retire early, cutting your monthly expenses can help you to achieve all of your financial goals. By taking a little cash from each budget item, you will see big savings in your monthly financial picture. Here are four surprising strategies to help […]

Watch Out! How Credit Loss is Calculated is Changing

One of the biggest costs that all businesses need to manage is credit loss. While a business can sell a lot of products, they still need to actually collect on revenue. Recently, the way that credit loss is calculated has changed dramatically. This has had a big impact on the profit and loss statements of […]

Thinking of Joining an MLM? Here’s 4 That Actually Sell

If you’re looking for a way to make extra money while working on your own schedule, a multi-level marketing company may be the answer. MLM is ideal for those who have an outgoing personality and know how to sell products and services to others. There are many different MLM companies out there, but the four […]

4 Industries with Growing Workforce Demand in 2019

For those who are looking to switch careers or preparing to graduate from high school or college, these are four industries with growing workforce demand in 2019 that you should be aware of. Home Services and Trades If you are looking to have a career in the trades, it may be a wise choice, depending […]

What Are Your Options With An Old 401(k)

Changing jobs is a part of life. Knowing what your options are with your old retirement plan can make the transition a little easier. Option 1: You can leave it alone. Pros: You don’t have to do anything. You can just leave it be. Cons: Now that you’re no longer an employee there may be […]

4 Ways You’re Wasting Money Every Month

Are you unconsciously wasting money every month? Chances are good that you could save a lot of money just by taking the following four actions into consideration. Buying Bottled Water Studies have shown that bottled water is hardly any better than water out of your tap — or possibly worse. Not only that, but the […]