Ohio Police & Fire

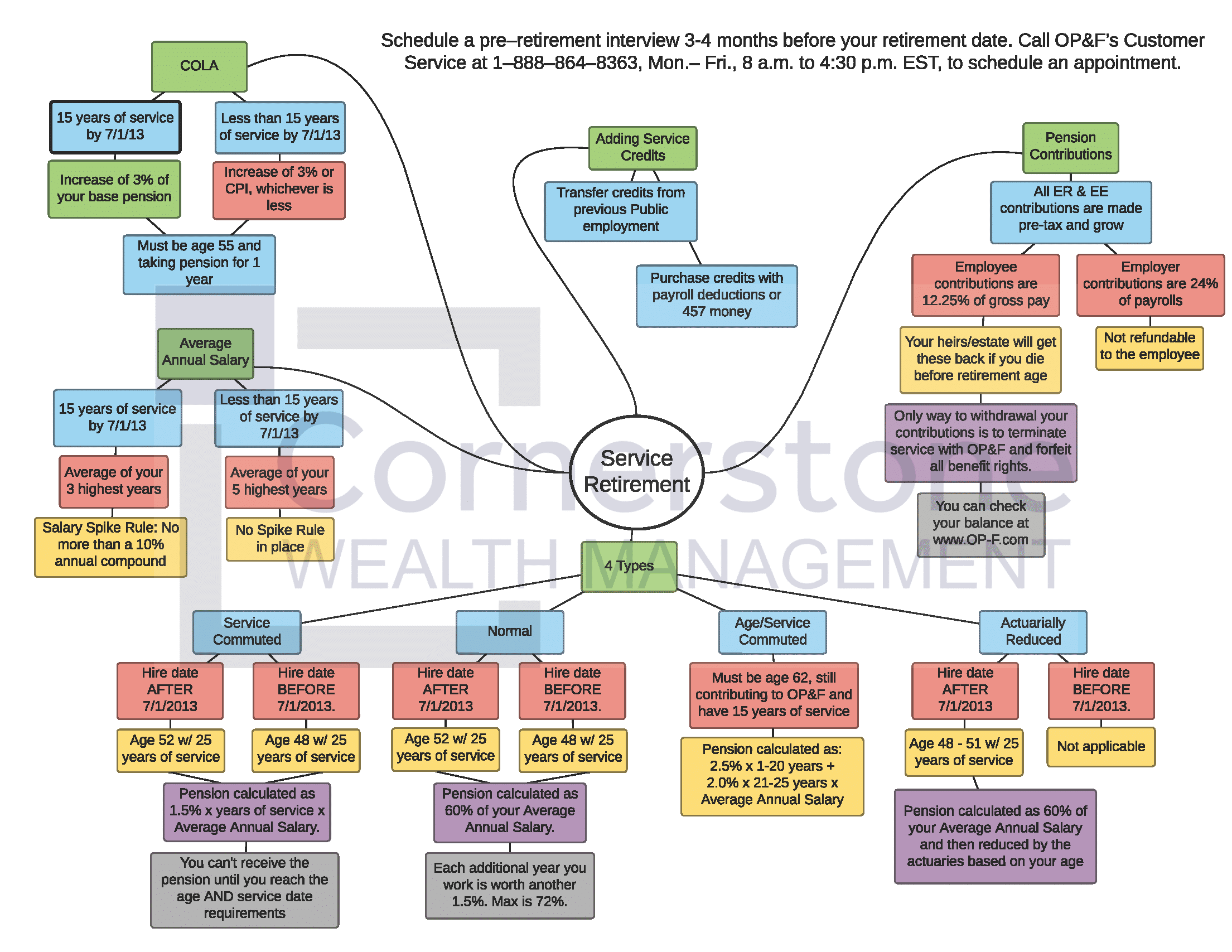

Service Retirement

Four distinct types of service retirement options are available to OP&F members; normal service, service commuted, age/service commuted and actuarially reduced. Each option has different age and service credit requirements and is designed to fit a variety of circumstances.

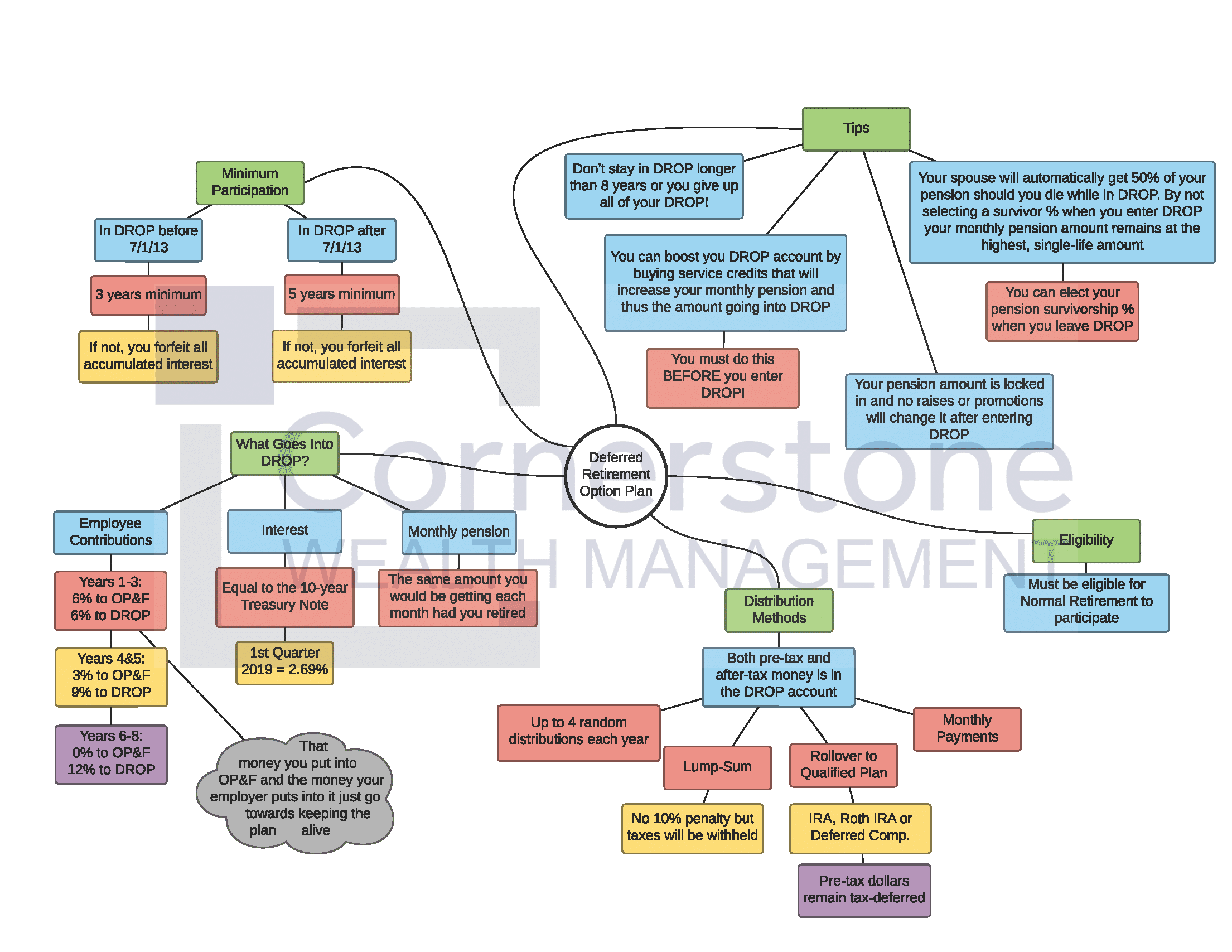

DROP

The Deferred Retirement Option Plan (DROP) was first offered in 2003. It’s an optional benefit that allows eligible police officers and firefighters to accumulate a lump-sum of money for retirement.

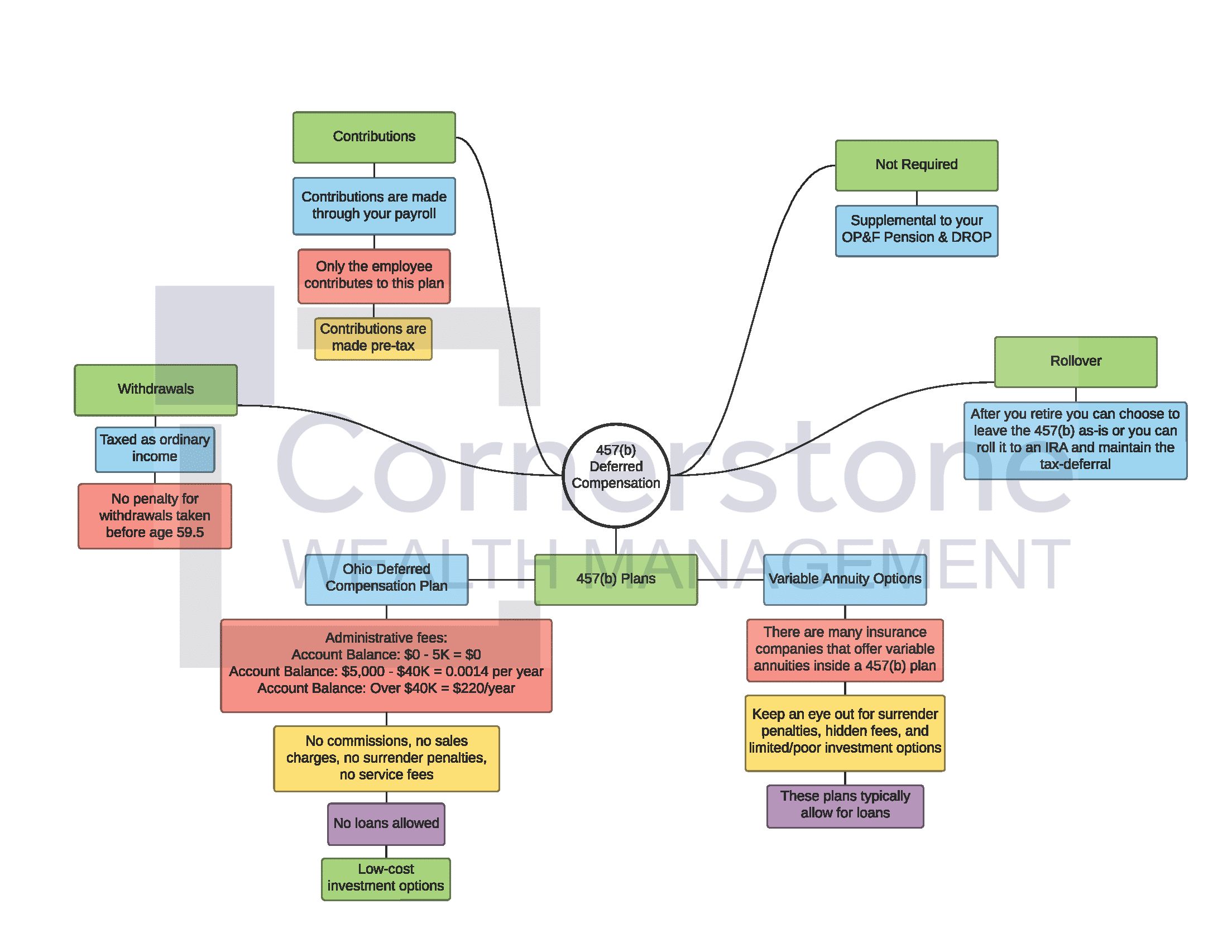

457(b) Deferred Compensation

A 457 plan refers to a non-qualified, tax-deferred compensation retirement plan. Eligible employees are allowed to make salary deferral contributions to the 457 plan. Earnings grow on a tax-deferred basis and contributions are not taxed until the assets are distributed from the plan.

Pension Payments

As a member of Ohio Police & Fire Pension Fund (OP&F), once you reach a certain age and obtain sufficient service credit, you are eligible to receive a pension for life. The size of the pension depends upon: your age and service credit, the annuity payment plan you select, and your allowable average annual salary.

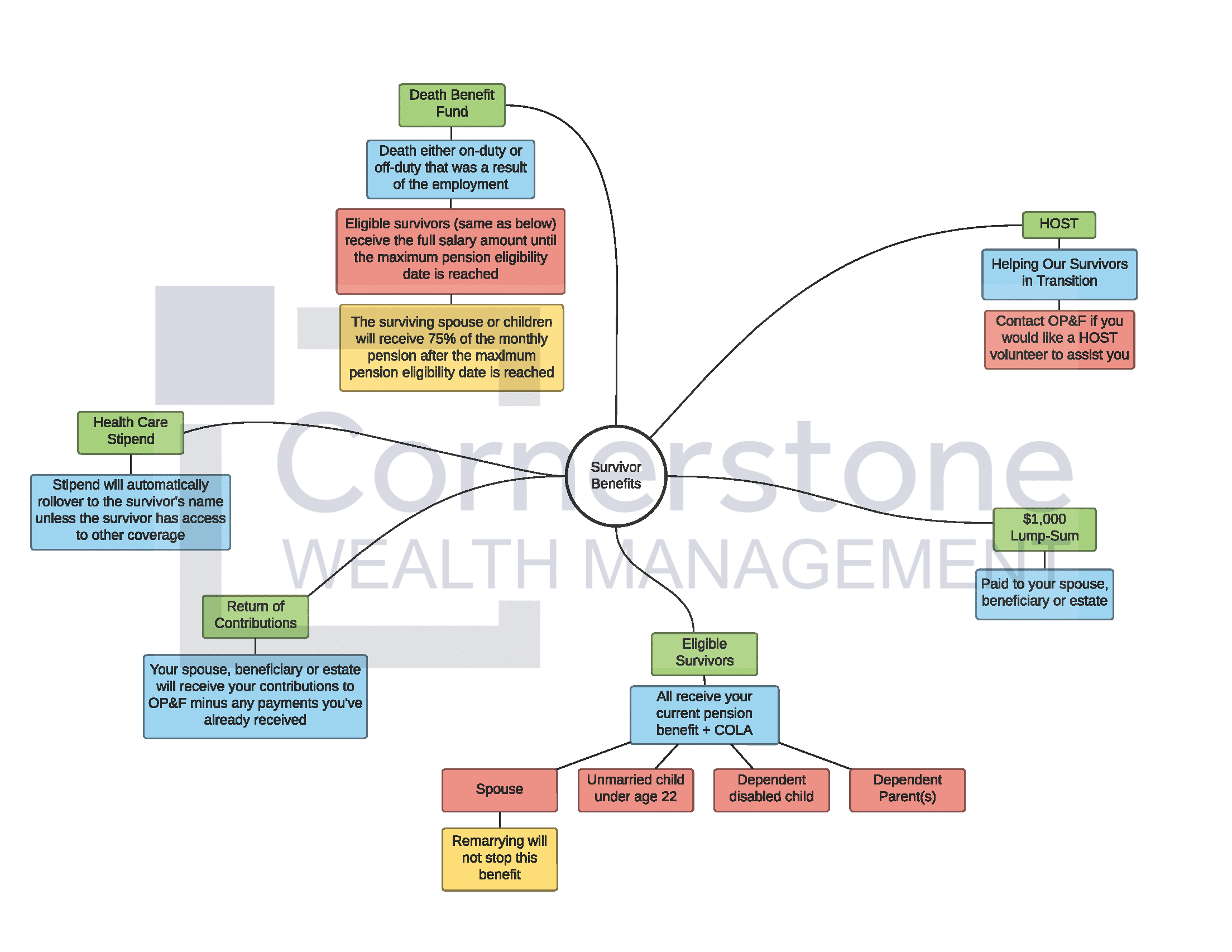

Survivor Benefits

Whether a police officer or firefighter dies before or after retirement, their survivors may be eligible to receive survivor benefits from OP&F.

Want More Information?

schedule some time for us to talk

*All the information above is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author, Michael Kelley, on the date of publication and are subject to change. This information does not involve the rendering of personalized financial advice. Each person should discuss their specific situation with a trusted advisor.