6 Estate Planning Tips For Your Business

As a business owner, you’ve invested time, money and your heart into building this income-producing enterprise. Estate planning is a legal method of protecting the business in case of unfortunate events. It’s a tailored business tool to control and manage the wealth you’ve built by preventing taxation seizures and safeguarding the intended transfer of ownership […]

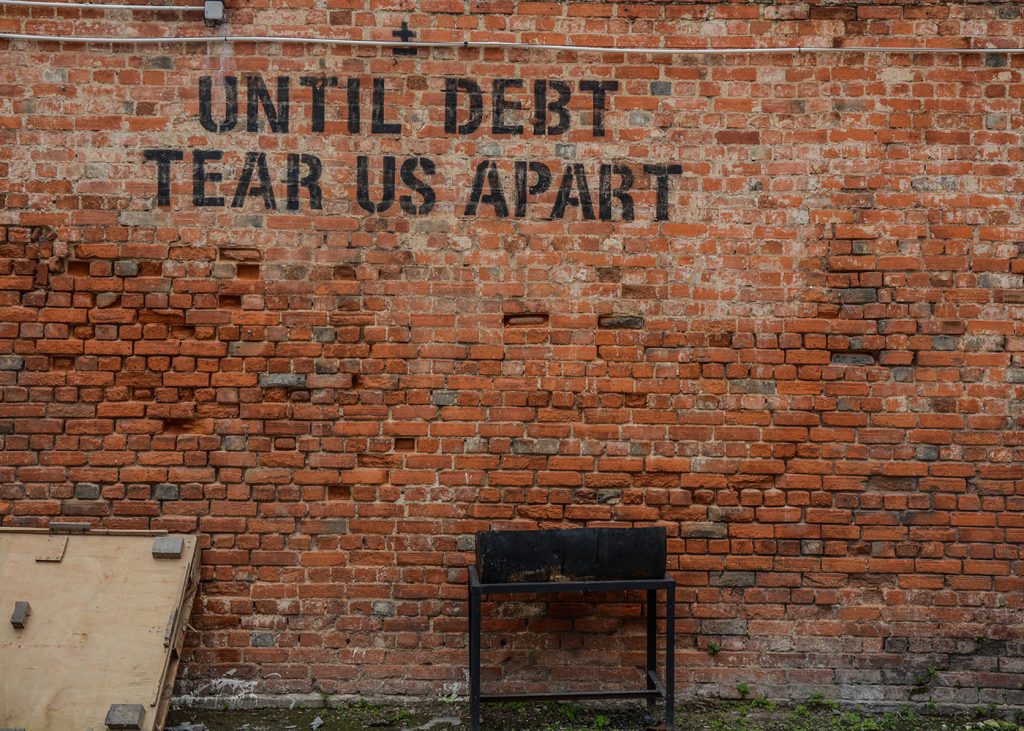

The Emotional Effects of Debt

If you’ve been fighting debt, you’re not alone. As it stands, the average American has $15,950 in credit card debt, and 39% of Americans carry a balance from month to month.1 Those figures aren’t counting people with mortgages, student loans, car notes, personal loans, and medical bills. There are a number of underlying issues that contribute […]

What is the Difference Between Modern Portfolio Theory and Behavioral Finance?

There are two different belief systems that serve as the basis for investment decisions: the modern portfolio theory (MPT) and behavioral finance (BF). A basic summary of the two schools of thought: the MPT focuses on the optimal state of the market, while BF is more focused on the actual state of the market. With […]

Smart Money Habits For Recent College Grads

If you recently graduated from college, congratulations are certainly in order! In addition to being a major life milestone, college graduation marks an important transition into adulthood. As such, it may also be the beginning of a new phase of personal finance management. The financial decisions you make during this phase in life have a lasting effect […]